Market demand and development space analysis of nylon industry in 2022

2022-11-16

Nylon industry family is huge and has a wide range of products. Nylon (Nylon) is polyamide, also known as nylon, nylon (domestic), the English name Polyamide, referred to as nylon, refers to the main chain contains repeated amide groups (-NHCO-) of a class of linear polymer. Nylon is a white crystalline or translucent thermoplastic resin with elasticity, excellent tensile strength, abrasion resistance, high mechanical strength and oil resistance. The nylon industry has a large family and a wide variety of products, mainly nylon 6, nylon 66, nylon 610, nylon 11, nylon 12 five varieties, in addition, there are nylon 1010, nylon 4, nylon 8, nylon 9, nylon 810 and a variety of copolymer modified nylon, of which the use of nylon 6 and nylon 66 is the largest, accounting for about 90% of the total consumption of nylon.

2. Nylon 6: rapid growth in supply and demand, full competition in the industry

Nylon 6 has a wide range of downstream applications, mainly used in nylon fiber, engineering plastics, film and other fields. Nylon fiber is one of the main chemical fiber species, according to the fiber length is divided into nylon 6 filament and nylon 6 short yarn: nylon 6 filament is mainly used in civil filament and industrial filament field, in civil, mainly used in clothing, bedding, bags, umbrellas, rope, curtain fabric, etc.; in industrial filament, mainly used in tire cord fabric, conveyor belt, transportation belt, fishing net, rope and cable, etc.; nylon short yarn is mainly used in carpet manufacturing In the field of engineering plastics, nylon 6 engineering yarn is mainly used in the production of carpets, as well as blended with other materials for socks and umbrella cloth. In the field of engineering plastics, nylon 6 engineering plastics have many excellent characteristics such as wear resistance, heat resistance, oil resistance, high tensile strength, excellent impact toughness, good self-lubrication, etc. Through modification and blending, they can be processed into various products to replace metal products, and have a wide range of applications in the automotive, electrical and electronic, machinery, transportation, medical, aerospace and other fields. In the field of film, biaxially oriented nylon (BOPA) film has good gas barrier, flexibility, transparency, abrasion resistance, etc. It is widely used in the packaging of steamed food, frozen food, seafood, medical products and electronic products.

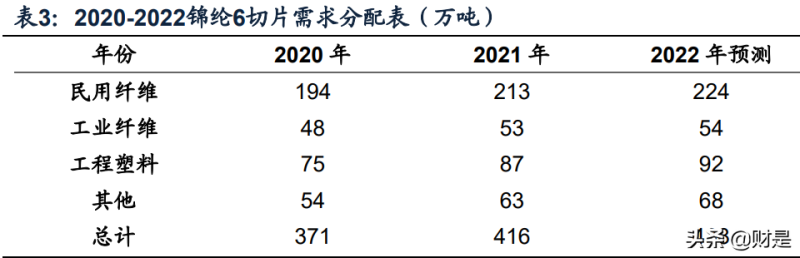

At present, nylon 6 chips are mainly used in the field of spinning. According to CCF annual report, the main downstream of nylon 6 chips in China are in the field of civil fiber, engineering plastics and industrial fiber, among which the fiber field dominates. In 2021, China's demand for nylon 6 chips will be 4.162 million tons, including 2.13 million tons in the civil fiber field, 868,000 tons in the engineering plastics field, 530,000 tons in the industrial fiber field and 634,000 tons in other fields.

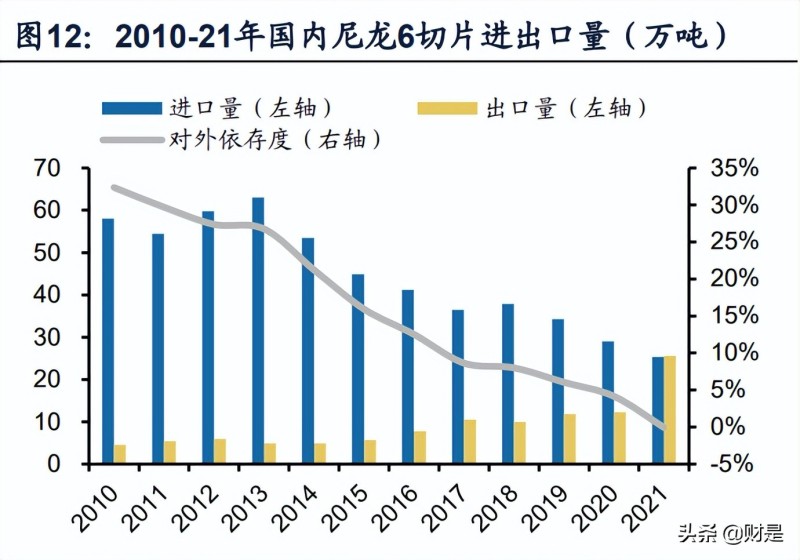

Nylon 6 demand is growing rapidly, with a CAGR of 8.7% from 2010-2021. According to the annual report of China Fiber Network, benefiting from the continuous development of the domestic textile industry and the continuous expansion of the nylon industry, the demand for domestic high-speed spinning nylon chips is increasing. The development of automobile industry, electronic machinery industry and food packaging industry also drives the demand for nylon engineering plastics and film grade chips to grow slightly, making the total domestic demand for nylon chips maintain growth in recent years. The compound growth rate of domestic demand for nylon 6 chips in China will reach 8.7% from 2010 to 2021, and the total consumption will reach 4.127 million tons in 2021. With the continuous growth of domestic production capacity, the import volume of nylon 6 chips in China has been decreasing, and the export volume has been increasing in recent years, and the import dependency has been decreasing year by year. Most of the domestic exports are engineering plastics chips, exports exceeded 100,000 tons after 2017, exports further increased to 122,000 tons in 2020. 2021 by the pressure of domestic overcapacity and the force majeure of overseas devices under the global epidemic, exports reached 253,000 tons in 2021.

CPL, the raw material, continues to expand its capacity, which helps PA6 to reduce its cost and release its volume. The rapid growth of China's PA6 production capacity is closely related to the localization of the raw material caprolactam (CPL) and the rapid growth of production capacity. cpl is the main raw material of nylon 6, and at the early stage of the development of the domestic nylon industry, China's cpl production capacity was insufficient and the import dependence was high. With the breakthrough of CPL localization technology, private enterprises entered the CPL industry on a large scale, the domestic CPL production capacity grew rapidly and the price dropped, which in turn promoted the rapid growth of PA6 production capacity. According to China Fiber and Zhuo Chuan information data, in 2021 CPL new production capacity of 1 million tons, and its China Lu and Yanshan combined 600,000 tons in the fourth quarter put into operation, this part of the capacity will be fully released in 2022, and in 2022 there are still 600,000 tons of new CPL device plans to put into operation, the new increase is significantly more than the nylon slices added. It is expected that the supply and demand of CPL will be loose in 2022, and the production efficiency of slicing plants is expected to improve.

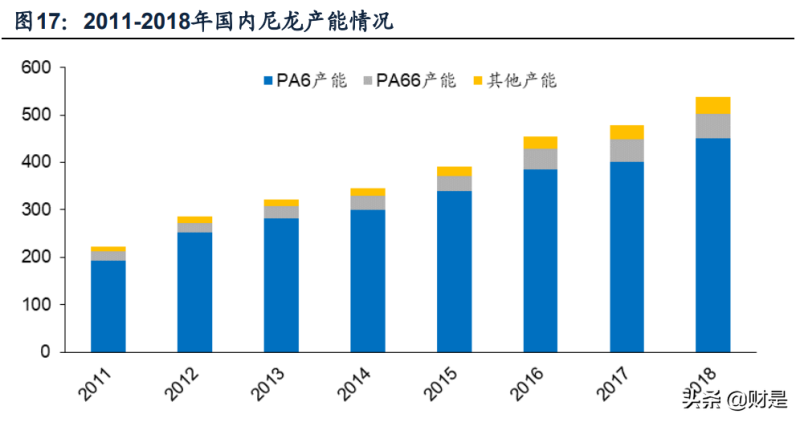

Production capacity continues to grow and concentration increases. Thanks to the continuous upward shift of the total demand, nylon polymer manufacturers' capacity has been steadily expanding, in 2011 China's nylon polymer production capacity of 1.685 million tons, in 2021 China's polymer production capacity grew to 5.715 million tons, capacity growth rate of 6%. According to the annual report of China Fiber Network, it is expected that the domestic polymer market capacity will still maintain expansion in 2022, according to the current plant planning and some small plant elimination progress, the capacity is expected to reach 6.145 million tons in 2022, with a growth rate of 7.5%.

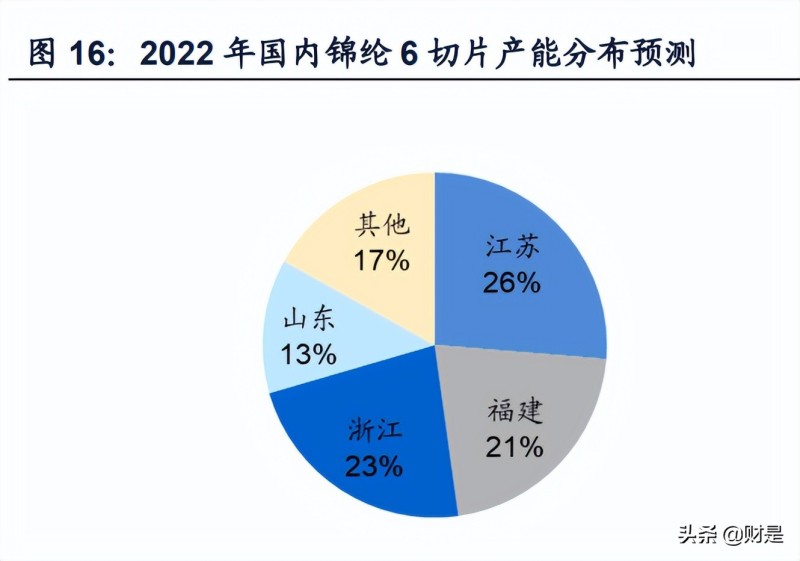

The scale of the industry is expanding and the concentration is increasing. According to CCF data, from the domestic nylon 6 slicing capacity distribution, Jiangsu, Fujian, Zhejiang, Shandong as the main production capacity gathering place, of which Jiangsu accounted for 25.9%, Fujian accounted for 22.6%, Zhejiang accounted for 22.9%, Shandong accounted for 10.6%. 2022, the domestic PA6 new projects are limited, only Shandong, Jiangsu, Zhejiang have new capacity, the overall pattern is not expected to change.

3. Nylon 66: upstream raw material localization breakthrough, PA66 ushered in a high increase in production capacity

PA66 is the second largest polymer in the nylon industry demand, domestic production capacity development lags behind. The main products of nylon industry are PA6 and PA66, according to the literature "the development status of domestic nylon 6 and nylon 66 industry", the global nylon industry, PA6 and PA66 production capacity, production accounted for about 95%. 2018 global PA6 total production capacity of 8.75 million tons, mainly concentrated in Europe and Asia, the domestic PA6 polymerization capacity of 4.1 million tons (China fiber network data), as the world's largest PA6 producer. The world's largest PA6 producer. In terms of PA66, the global production capacity of 2.82 million tons, mainly concentrated in North America, Northeast Asia, Western Europe and other places, the main producers include INVISTA, DuPont, Awshengde, BASF, etc., the domestic PA66 production capacity in 2018 only 512,000 tons.

Raw material capacity limits the development of domestic PA66 capacity. The main reason for the relatively slow development of domestic PA66 is the supply of raw materials. In the domestic nylon industry, benefiting from the localization of domestic caprolactam production capacity, PA6 production capacity has increased year by year, and has rapidly become the world's largest PA6 production capacity concentration, but PA66 production capacity has been constrained by the lack of mature adiponitrile production technology in China, resulting in the "adiponitrile-hexanediamine-PA66" industry chain is highly monopolized by oligarchs, and domestic PA66 producers need to import a large number of adiponitrile or adipamide or PA66 salt as raw materials.

PA66 has a wide application space in engineering plastics and chemical fiber fields. PA66 is a "high-end" product in nylon due to its high strength, good wear resistance, excellent lubricity, and relative resistance to high temperature, and is widely used in rubber, tire, plastic, electronics, chemical, chemical fiber and other industries. Nylon 66 has more advantages in color fastness and elasticity, and is more suitable for outdoor sports, yoga wear and other products. Nylon 66 has the advantage of high melting point + smooth hand, more suitable for manufacturing heat-resistant strain products, high-grade clothing fabrics, and because of the tight crystallization and high density, effectively prevent the down from drilling, suitable for down clothing, down quilt, etc. Meanwhile, the application of PA66 in the field of engineering plastics accounts for about 60% of its consumption. Because of its high strength, good rigidity, impact resistance, oil resistance, wear resistance and other characteristics, it has a large application space in the field of automotive parts, electric power and electronic appliances. At present, China is the largest automobile production and consumption country, at the same time, considering the development of new energy automobile industry with high requirements for light weight, it is expected that our future demand for PA66 will still have a large incremental space.

PA66 is made from adipic acid and adipamide through condensation reaction, among which adipic acid production technology includes cyclohexanol nitric acid oxidation method, cyclohexene direct oxidation method and butadiene carbonyl synthesis method, and there are mature production process and large-scale production capacity in China. The production process of adiponitrile includes butadiene, acrylonitrile electrolytic dimerization and adipic acid catalyzed ammoniation. At present, the domestic adiponitrile industry is in a critical period of localization breakthrough.

Domestic PA66 production capacity is about to usher in rapid growth, and the competitive pressure in the industry has intensified. The breakthrough of the localization of adiponitrile is expected to drive the rapid development of domestic PA66 production capacity, many domestic companies actively layout PA66 projects, in addition to the PA66 plant supporting the production of adiponitrile plant, other domestic enterprises with raw materials and market advantages are also actively developing to the PA66 field. It is expected that the competitive pressure in the domestic PA66 industry will intensify in the coming period, and the industrial development of PA66 in China may replicate the development process of PA6 industry, and the profit space of the industry may fall significantly from the current high level, and the enterprises with cost advantage and technical advantage are expected to stand out.